tax on unrealized gains canada

Donate your shares to charity. As a result an adjustment may be required on Schedule 1 of the.

Receipt or payment of Canadian dollars of an account is made within the taxation year any foreign exchange gain or loss is reflected in income in that.

. An unrealized capital gains tax is a tax on profits that didnt realize yet. Lifetime capital gain exemption. Donate your shares to charity.

Lifetime capital gain exemption. The capital gains tax only applies to realized capital. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000.

6 Ways to Avoid Capital Gains Tax in Canada. Because you only include onehalf of the capital gains from these properties in your taxable. The final dollar amount youll pay will depend on how much.

In Canada 50 of the value of any capital gains is taxable. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. This means that if you earn 1000 in capital gains and.

In our example you would have to. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. Donate your shares to charity.

6 Ways to Avoid Capital Gains Tax in Canada. Its a tax on profits you have yet to receive. In Canada only 50 of the capital gain you realize on stocks is taxed the other 50 is yours to keep tax-free.

If full or partial settlement ie. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. Lifetime capital gain exemption.

A stock or piece of real estate that. So if you buy a stock for 1000 you would have unrealized capital gains. Regardless of whether or not the sale of a capital property results in a capital gain or loss you have to file an income tax and benefit return to report the transaction even if you do not have.

For example if you buy a. 6 Ways to Avoid Capital Gains Tax in Canada. Investors pay Canadian capital gains tax on 50 of the capital gain amount.

The remaining 41750 is the. If you decide to sell youd now have 14 in realized capital gains. The sale price minus your ACB is the capital gain that youll need to pay tax on.

American citizens living in Canada for more than five years face an imposed exit tax on unrealized gains. Capital gains are in two categories. 6 Ways to Avoid Capital Gains Tax in Canada.

How much tax do you pay on stock gains in Canada. Lifetime capital gain exemption. Non-resident corporations are subject to CIT on taxable capital gains 50 of capital gains less 50 of capital losses arising on the disposition of taxable Canadian property.

As the foreign exchange of the account balance will fluctuate after the year-end it is considered unrealized. Donate your shares to charity. If the equity investment value increases you must pay capital gains tax.

Which Country Has The More Favorable Capital Gains Tax Canada Or America Quora

Walmart Releases Q1 Fy21 Earnings

Frequently Asked Questions Blackrock

Maximizing Nua Benefits For Employee Stock Ownership Plans

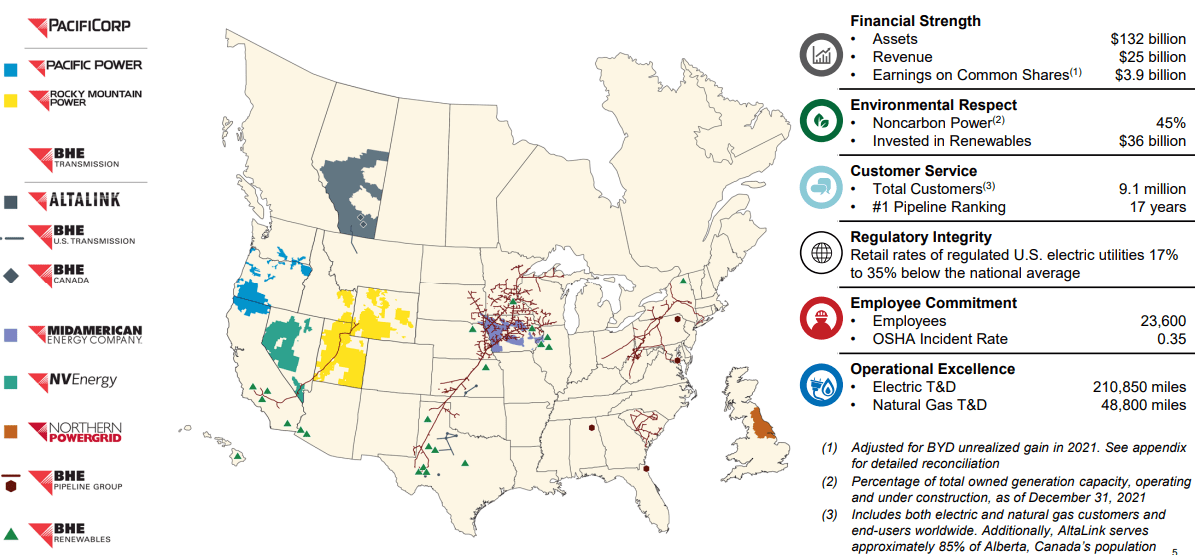

Berkshire Hathaway Is Now A Utility Company Nyse Brk A Seeking Alpha

Taxation Of Investment Income Within A Corporation Manulife Investment Management

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

Capital Gains Tax Canada Explained

What Is Tax Gain Harvesting Charles Schwab

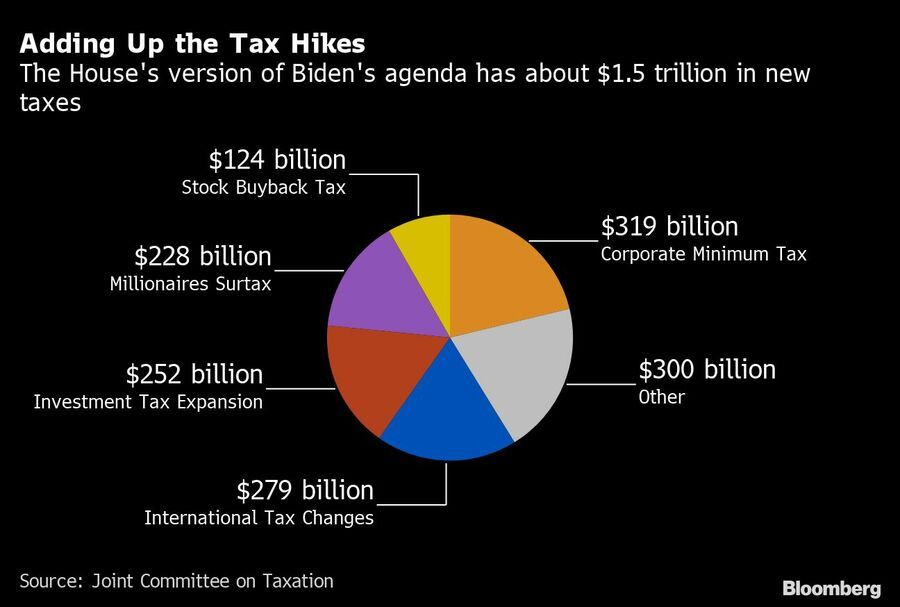

Proposed End Of Carried Interest Means Tax Hikes For Rich Wall Streeters

Turning Losses Into Tax Advantages

The Exit Tax When Moving From The U S To Canada

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

Canadians Are Taxed On Illusory Capital Gains The Globe And Mail

Northern Trust Wealth Management Asset Management Asset Servicing

Tax Systems Of Scandinavian Countries Tax Foundation